Not known Incorrect Statements About Custom Private Equity Asset Managers

You have actually most likely become aware of the term private equity (PE): buying companies that are not publicly traded. Approximately $11. 7 trillion in properties were managed by exclusive markets in 2022. PE firms look for opportunities to earn returns that are better than what can be attained in public equity markets. But there might be a few points you do not comprehend about the sector.

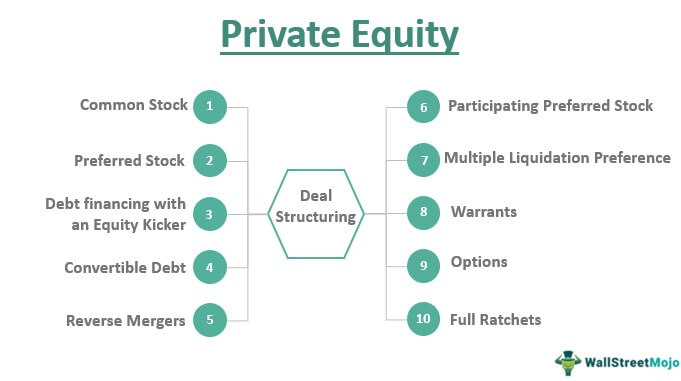

Exclusive equity firms have a variety of investment choices.

Since the most effective gravitate towards the larger bargains, the middle market is a dramatically underserved market. There are extra vendors than there are highly skilled and well-positioned money experts with substantial buyer networks and sources to take care of a bargain. The returns of personal equity are normally seen after a few years.

The Of Custom Private Equity Asset Managers

Flying listed below the radar of large multinational corporations, several of these small firms typically supply higher-quality customer care and/or specific niche product or services that are not being used by the large corporations (https://anotepad.com/note/read/gtek6cnk). Such benefits attract the interest of personal equity firms, as they have the insights and wise to make use of such chances and take the firm to the next level

Personal equity capitalists should have dependable, capable, and dependable administration in location. Many managers at portfolio companies are given equity and reward payment frameworks that compensate them for hitting their economic targets. Such alignment of goals is typically required before an offer gets done. Personal equity chances are usually unreachable for people that can not spend numerous dollars, however they shouldn't be.

There are regulations, such as limitations on the aggregate amount of cash and on the number of non-accredited capitalists. The exclusive equity service draws in a few of the most effective and brightest in business America, consisting of leading performers from Ton of money 500 business and elite administration consulting companies. Law office can likewise be hiring grounds for personal equity works with, as accounting and legal skills are essential to full offers, and purchases are very searched find out here now for. https://custom-private-equity-asset-managers.jimdosite.com/.

Custom Private Equity Asset Managers - An Overview

One more drawback is the lack of liquidity; when in a personal equity deal, it is not easy to get out of or sell. There is a lack of flexibility. Private equity likewise features high costs. With funds under management currently in the trillions, private equity companies have actually become eye-catching financial investment vehicles for affluent individuals and establishments.

For decades, the characteristics of private equity have made the possession course an attractive proposal for those who can participate. Since access to personal equity is opening approximately more specific capitalists, the untapped possibility is becoming a truth. So the concern to take into consideration is: why should you spend? We'll start with the main arguments for purchasing personal equity: How and why private equity returns have traditionally been more than various other possessions on a number of degrees, Exactly how including private equity in a portfolio affects the risk-return profile, by helping to diversify against market and cyclical danger, Then, we will lay out some essential considerations and dangers for personal equity investors.

When it involves presenting a new possession into a portfolio, the most fundamental factor to consider is the risk-return account of that asset. Historically, personal equity has shown returns comparable to that of Arising Market Equities and more than all various other conventional asset classes. Its reasonably reduced volatility combined with its high returns produces an engaging risk-return profile.

Getting The Custom Private Equity Asset Managers To Work

Personal equity fund quartiles have the best array of returns across all different property courses - as you can see listed below. Approach: Interior price of return (IRR) spreads out calculated for funds within vintage years individually and after that averaged out. Mean IRR was calculated bytaking the average of the average IRR for funds within each vintage year.

The takeaway is that fund selection is essential. At Moonfare, we perform a rigorous option and due diligence process for all funds listed on the system. The result of including private equity right into a profile is - as always - depending on the portfolio itself. Nonetheless, a Pantheon research from 2015 suggested that including exclusive equity in a profile of pure public equity can open 3.

On the various other hand, the most effective private equity firms have access to an even larger pool of unidentified opportunities that do not deal with the exact same analysis, as well as the sources to execute due diligence on them and identify which are worth spending in (Private Equity Platform Investment). Spending at the very beginning means higher threat, but for the companies that do succeed, the fund advantages from greater returns

A Biased View of Custom Private Equity Asset Managers

Both public and personal equity fund supervisors dedicate to investing a portion of the fund however there stays a well-trodden problem with straightening rate of interests for public equity fund monitoring: the 'principal-agent issue'. When an investor (the 'major') hires a public fund manager to take control of their funding (as an 'representative') they hand over control to the supervisor while preserving possession of the assets.

In the instance of personal equity, the General Partner does not just earn a monitoring charge. They likewise make a percent of the fund's profits in the form of "carry" (usually 20%). This ensures that the interests of the manager are straightened with those of the capitalists. Exclusive equity funds likewise alleviate another type of principal-agent problem.

A public equity capitalist ultimately wants one thing - for the monitoring to raise the stock rate and/or pay returns. The capitalist has little to no control over the decision. We revealed over the number of private equity approaches - especially bulk buyouts - take control of the running of the company, making certain that the long-lasting worth of the company precedes, pressing up the return on investment over the life of the fund.